Are you interested in starting your journey as a trader but not sure where to begin? Creating an account with TradeXN is a great first step to getting started with trading stocks, currencies, commodities, and more. TradeXN is a leading online brokerage that offers traders access to global markets with competitive fees and powerful trading platforms.

To open an account, simply visit the TradeXN website and click “Open Account” in the top right corner. You’ll be guided through a quick registration process where you’ll need to provide some basic personal information.

How To Make A Deposit?

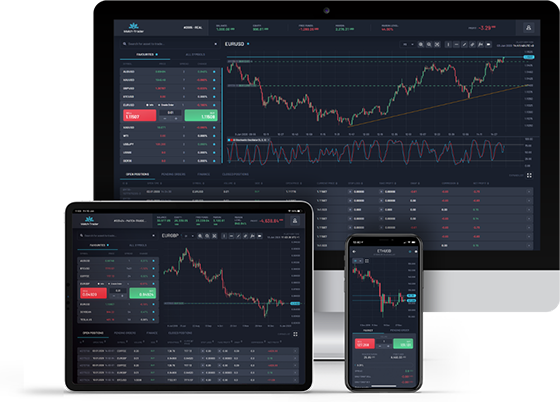

After creating your account, it’s time to make your first deposit. TradeXN accepts a variety of deposit methods including crypto, debit/credit cards, and more. With your account now funded, you can also download TradeXN’s powerful desktop trading platforms. TradeXN trading platform give you real-time market data and access to thousands of global markets. The intuitive interfaces also allow you to place trades with just a few clicks. Take some time to familiarize yourself with the platforms and available charting, analytics, and order entry tools before making your first trade.

Ready To Place Your First Trade?

When you’re ready to place your first trade, decide what type of market you want to trade – stocks, forex, commodities, indices, or cryptocurrencies. Then search for the market you want to trade using the platform’s search bar. Review market details like current price, daily price movements, news, and analyst ratings to help inform your trade decision.

To place a trade, simply select whether you want to buy or sell the market. Then enter details like the lot size you want to trade, your desired price limit if using a limit order, and any applicable stop or take profit levels. Review your order details carefully before submitting it for execution.

Benefits of Trading with TradeXN

Trading with TradeXN offers several key benefits that cater to both experienced and novice traders:

- Zero Commission: TradeXN provides a cost-effective trading environment by offering zero commission on trades. This means that traders can execute transactions without incurring additional fees, allowing for more efficient and affordable trading.

- Fastest Execution: The platform prides itself on its high-speed execution, ensuring that trades are processed swiftly. This is crucial in the fast-paced world of financial markets, where timely execution can be the difference between profit and loss.

- Quick Deposit and Withdrawals: TradeXN facilitates seamless financial transactions, allowing users to quickly deposit funds into their accounts and withdraw profits with ease. This quick turnaround time enhances the overall user experience and provides greater flexibility for traders.

- Diverse Asset Classes: Traders on TradeXN have access to a wide range of financial instruments, including stocks, forex, commodities, indices, and cryptocurrencies. This diversity allows traders to create a diversified portfolio and explore various market opportunities.

- Support: TradeXN offers robust customer support, providing assistance to traders whenever needed. A responsive support system ensures that traders can address any concerns or queries promptly, contributing to a smoother trading experience.

- Regulation: Regulatory compliance is a crucial aspect of any trading platform. TradeXN operates under established regulatory frameworks, providing traders with a sense of security and trust. Regulatory oversight helps ensure fair and ethical practices within the trading environment.

- Technology: The platform leverages advanced technology to enhance the trading experience. Whether through user-friendly interfaces, advanced charting tools, or cutting-edge trading algorithms, TradeXN strives to stay at the forefront of technological innovation in the financial industry.

Pros and Cons of Demo Accounts:

Pros:

- Skill Development:

Demo accounts provide a risk-free environment for traders to practice and develop their trading skills. This allows them to familiarize themselves with the platform and various trading strategies without the fear of financial loss.

- Market Familiarization:

Traders can use demo accounts to become familiar with different financial instruments and market conditions. This helps in understanding how various assets behave and how different strategies may perform.

- Testing Strategies:

Demo accounts allow traders to test and refine their trading strategies in real-time market conditions. This is essential for assessing the viability and effectiveness of a strategy before applying it to a live account.

- Risk-Free Learning:

Since no real money is at stake, traders can experiment with new techniques and approaches without the emotional stress associated with potential financial losses.

Cons:

- Emotional Disconnect:

One major drawback of demo accounts is the lack of real emotional involvement. Traders might not experience the same emotions and psychological challenges that come with trading real money.

- Overconfidence:

Success in a demo environment may lead to overconfidence. Traders might assume that similar success is guaranteed in a live market, which may not be the case due to the absence of real financial risk.

- Incomplete Simulation:

Demo accounts may not fully replicate the slippage, order execution delays, and other real-market factors that can impact trading outcomes. This can create a false sense of security.

Emotional Effect of Demo Account vs Real Account:

Demo Account:

Traders often experience a lower level of emotional stress since there is no real money on the line. This can lead to a more relaxed and less pressured trading environment.

Real Account:

Trading with real money introduces emotions such as fear, greed, and anxiety. The impact of financial losses or gains becomes tangible, affecting decision-making and overall emotional well-being.

Psychological Effect of Demo Account vs Real Account:

Demo Account:

Traders may not experience the same psychological challenges as in a live environment, such as dealing with the fear of loss or the excitement of profit.

Real Account:

The fear of losing real money and the emotional impact of financial gains or losses can significantly influence decision-making and overall psychological well-being.

Why Trade with Your Own Money:

- Real Accountability:

Trading with real money adds a level of accountability, encouraging traders to approach the market with a more serious and disciplined mindset.

- Emotional Connection:

Real money involvement creates a more authentic emotional connection to the trading process, helping traders develop the emotional resilience needed for successful trading.

- Accurate Assessment:

Trading with real money provides a more accurate assessment of one’s trading abilities and the effectiveness of chosen strategies.

Risk Management:

- Preservation of Capital:

Effective risk management is crucial for preserving capital. Traders should determine the amount of capital they are willing to risk on each trade to avoid significant losses.

- Position Sizing:

Proper position sizing helps control risk by ensuring that no single trade can excessively impact the overall trading account.

- Use of Stop-Loss Orders:

Implementing stop-loss orders is a key risk management tool, automatically exiting a trade at a predetermined level to limit potential losses.

- Diversification:

Diversifying a trading portfolio across different assets and strategies can help spread risk and reduce the impact of a single losing trade.