What is a Rounding Top Pattern?

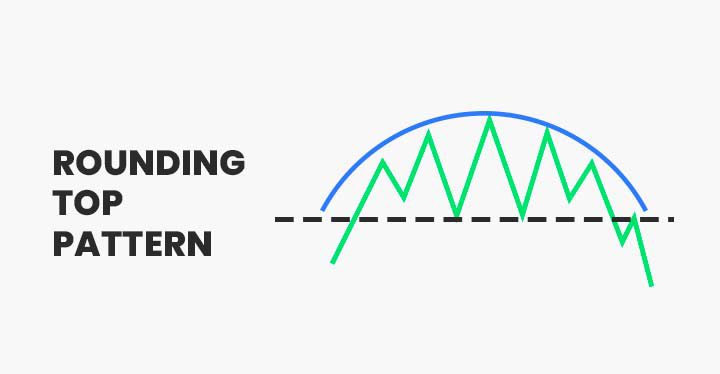

A rounding top pattern is a reversal pattern that forms at the end of an uptrend in the price of an asset. It signals a potential trend change from bullish to bearish. In a rounding top pattern, the price rises to new highs over successive peaks but struggles to break above the previous high each time. This results in a rounding shape at the top of the pattern.

How Does Rounding Top Pattern Work?

The rounding top pattern formation goes through three distinct stages:

Initial Buildup of Rounding Top Reversal Pattern In this initial stage, the price rises and makes successive higher peaks indicating an ongoing bullish trend. However, with each new peak, the price struggles to rise above the previous high and forms a rounding shape at the top. This shows weakening bullish momentum.

Second Stage

In the second stage, the peaks start getting narrower and the troughs between peaks start rising higher. This indicates that buyers are losing control over the price. The rounding shape at the top becomes more pronounced.

Final Stage

In the final stage, the price makes one last attempt to break above the previous high but fails. It then reverses direction and breaks below the nearest trough. This confirms the rounding top pattern and signals a trend change from bullish to bearish.

When Does the Rounding Top Pattern Breakout Occur?

For the rounding top pattern to be validated, the price needs to break below the lowest trough formed during the pattern development. This confirms the reversal of the prevailing uptrend. Traders can enter short positions as the price breaks below the trough. The ideal breakout point is a close below the trough to avoid fakeouts.

Benefits of Using the Rounding Top Pattern

- It provides an early warning sign of an impending trend change from an uptrend to a downtrend.

- The rounding shape formation makes it visually identifiable and easy to spot on price charts.

- It gives clarity on entry and exit levels for short trades – below the lowest trough for entry and above the highest peak for exit.

- Risk can be well-defined by setting stop-losses above the highest peak in the pattern.

- It works well across different time frames from daily to weekly charts.

Risk of Using the Rounding Top Pattern

- Patterns sometimes provide false signals due to random market noise. Strict confirmation is needed.

- The trend may not reverse even after a break below the trough in some cases.

- Strong support or resistance levels near the breakout point can cause whipsaws.

- Fundamental news events can override the technical pattern signal.

Relation Between Rounding Top to Double Top

A rounding top pattern is similar to a double top but has some key differences. In a double top, the two peaks are nearly equal in height whereas in a rounding top, each successive peak is lower than the previous one, forming a rounding shape. Also, in a double top, the decline after the break below the neckline is usually sharp but in a rounding top, the reversal is more gradual. Rounding tops also tend to play out over a longer time period compared to double tops.

Identifying Rounding Top Patterns

Let’s look at some examples of rounding top patterns in past on crypto charts:

Bitcoin Daily Chart (June – July 2022): As seen in the chart, BTC rose to form higher peaks in June but struggled to break above the previous high each time. This resulted in a rounding top formation at the top. It then broke below the lowest trough in mid-July, confirming the reversal. Short positions taken below the trough proved profitable as prices declined sharply afterwards.

Ethereum Weekly Chart (November 2021 – January 2022): ETH rose sharply in November 2021 to form a peak. It then struggled to rise above this level over subsequent weeks, rounding over. In early January 2022, it broke below the lowest trough, validating the rounding top pattern. The downtrend lasted several weeks, allowing shorts to profit.

Litecoin Daily Chart (March – April 2022): LTC rose to carve out higher peaks in late March but struggled at resistance. This led to the formation of a rounding top. In early April, it broke below the lowest swing low, confirming the bearish reversal. Prices declined over 15% within a month, rewarding shorts.

Using Candlestick Patterns with Rounding Tops Rounding top patterns work best when combined with candlestick patterns. For example:

- A bearish engulfing or dark cloud cover candlestick formation at the final peak adds confidence to the rounding top signal.

- A hanging man or shooting star candle near the breakout point from the rounding top pattern confirms the reversal.

- Placing the entry for short trades below the low of a bearish candle provides a safer entry point compared to a simple close below the trough.

- Trailing stops can be moved to breakeven or placed above the last swing high once a bearish candlestick pattern forms after the breakout.

Managing Risk with the Rounding Top Pattern

It is imperative that traders manage risk properly when taking positions based on rounding top signals:

- Only enter shorts on a close below the lowest trough for confirmation.

- Keep stops above the highest peak in the pattern to limit losses to the pattern height.

- Be aware of strong support levels near the breakout point that can cause whipsaws.

- Look for additional confirmation from oscillators turning bearish or negative divergence.

- Scale out of partial positions on rebounds and tighten stops on remaining holdings.

- Avoid chasing patterns during strong trends and look for reversals on lower time frames.

In conclusion, the rounding top pattern is a useful reversal indicator that provides an early warning of a potential trend change from an uptrend to a downtrend. By understanding how it forms and identifying the different stages, traders can spot this pattern on crypto charts and utilize it for well-defined short trades with a good risk-to-reward setup. Proper confirmation is needed for the pattern signal.