In the world of cryptocurrency trading, understanding different technical analysis or technical indicators tools is crucial. Among them, triple top and bottom patterns are two commonly used patterns for predicting price trends in crypto trading. These patterns occur in all markets, including cryptocurrencies.

What Is the Triple Bottom Pattern in Crypto?

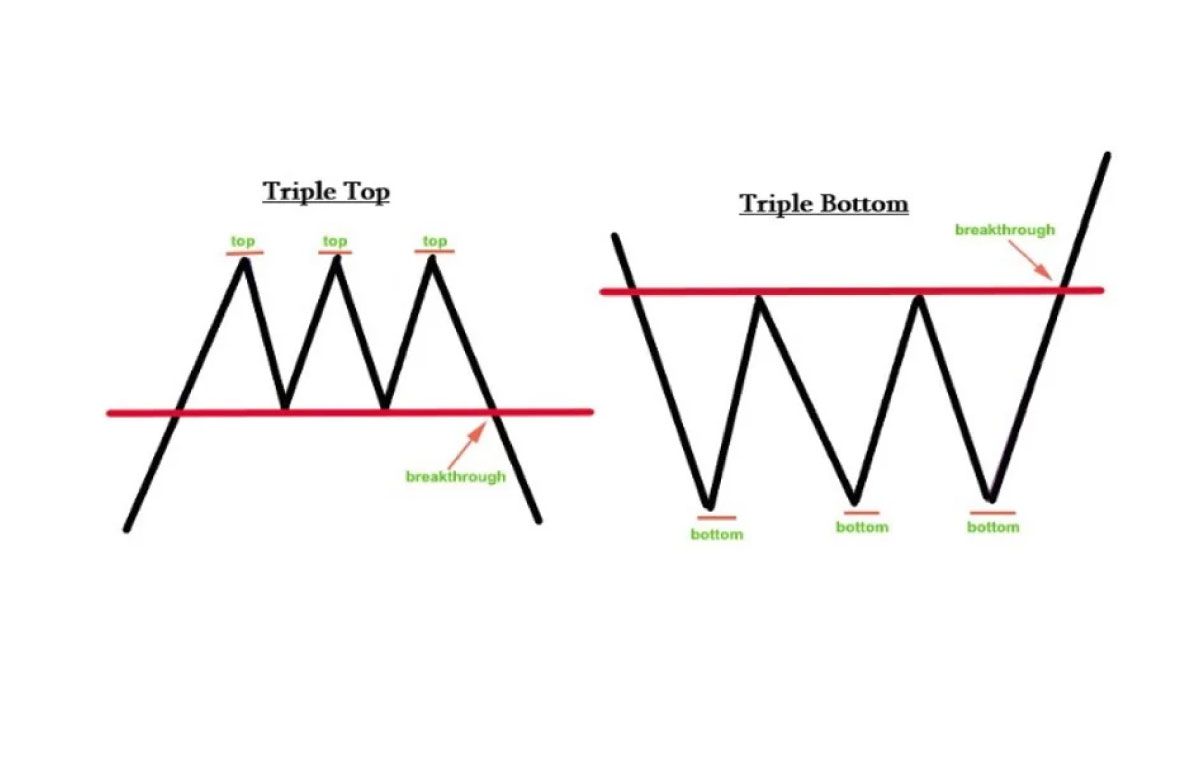

A triple bottom pattern is a bullish reversal pattern that forms after a downtrend. It represents the market’s attempt to find support at a certain price level. A Three valleys pattern consists of three equal lows with a resistance level in between. Traders interpret the Three troughs pattern as a signal that the market has reached a bottom and is about to reverse its trend in crypto trading.

Understanding a Bullish and Bearish Reversal Pattern

A bullish pattern is a chart pattern that indicates a change in the trend from a bearish to a bullish trend. A bullish reversal pattern typically occurs after a downtrend and signals that the price will likely go up in the future. Examples of bullish reversal patterns include double bottom, head and shoulders, and triple bottom.

On the other hand, a bearish reversal pattern signals a change in the trend from a bullish to a bearish trend. It typically occurs after an uptrend and indicates that the price will likely go down in the future. Examples of bearish reversal patterns include double top, head and shoulders, and triple top.

What Does the Triple Bottom Pattern Represent?

A triple bottom pattern represents a strong level of support, where the market has found a bottom three times. This support level can act as a barrier for the price to drop further, leading to a bullish reversal. When the price breaks above the resistance level, it is a signal that the market has shifted from a downtrend to an uptrend.

The triple bottom pattern is a reliable chart pattern, and traders often use it to identify buying opportunities. However, it is important to note that no chart pattern can guarantee a hundred percent accuracy, and traders should always use other technical indicators and risk management strategies to make informed decisions.

What Is the Triple Top Pattern?

The triple top pattern is a bearish reversal pattern that forms after an uptrend. It consists of three equal highs with a support level in between. The triple top pattern represents the market’s attempt to find resistance at a certain price level. Traders interpret the triple top pattern as a signal that the market has reached a top and is about to reverse its trend.

How to Spot Triple Top and Bottom Patterns in a Crypto Trading

To spot a triple top or bottom pattern in crypto trading, traders need to look for three equal highs or lows and a resistance or support level in between. The price must touch the support or resistance level at least three times, forming a horizontal line. Once the pattern is confirmed, traders can enter a long or short position, depending on the pattern.

Traders should also look for volume confirmation. If the volume is decreasing during the pattern formation, it is a warning sign that the pattern may not be reliable. On the other hand, if the volume is increasing during the pattern formation, it is a strong signal that the pattern is valid.

Conclusion

Triple top and bottom patterns are commonly used technical analysis tools in crypto trading. Traders use these patterns to predict future price movements and identify buying or selling opportunities. Understanding these patterns is crucial for any trader who wants to make informed decisions and minimize risks.