Key Takeaways

- A weighted moving average (WMA) is a type of moving average that assigns a higher importance to more recent data points.

- To calculate a WMA, more recent data is assigned a higher weight which decreases exponentially as the data becomes older.

- WMA can be used to identify trends and filter out short-term volatility from price changes. It helps traders identify potential buy and sell signals.

- The pros of WMA include giving more importance to recent prices and smoothing out short-term fluctuations. The cons are that it is more complex than simple moving average and past data is discarded.

How to calculate weighted moving average?

To calculate a weighted moving average, you first need to decide the period or number of data points you want to include in the average. Let’s say we want to calculate a 5-period WMA.

We assign weights to each data point in descending order, so the most recent data gets the highest weight. A commonly used weighting scheme is 2/5, 2/5, 1/5, 1/5, 1/5 but you can use any weighting scheme that sums to 1.

Then, you multiply each data point by its assigned weight. Add up the weighted values and divide the total by the sum of the weights. This gives you the weighted moving average.

For example, if the past 5 closing prices are 100, 105, 110, 95, 90, the calculation would be:

(100 * 2/5) + (105 * 2/5) + (110 * 1/5) + (95 * 1/5) + (90 * 1/5) = 40 + 42 + 22 + 19 + 18 Divided by the total weight which is 2 + 2 + 1 + 1 + 1 = 7 = 141/7 = 20.142857 ~ 20

So the 5-period weighted moving average is 20. You repeat this calculation as new data comes in.

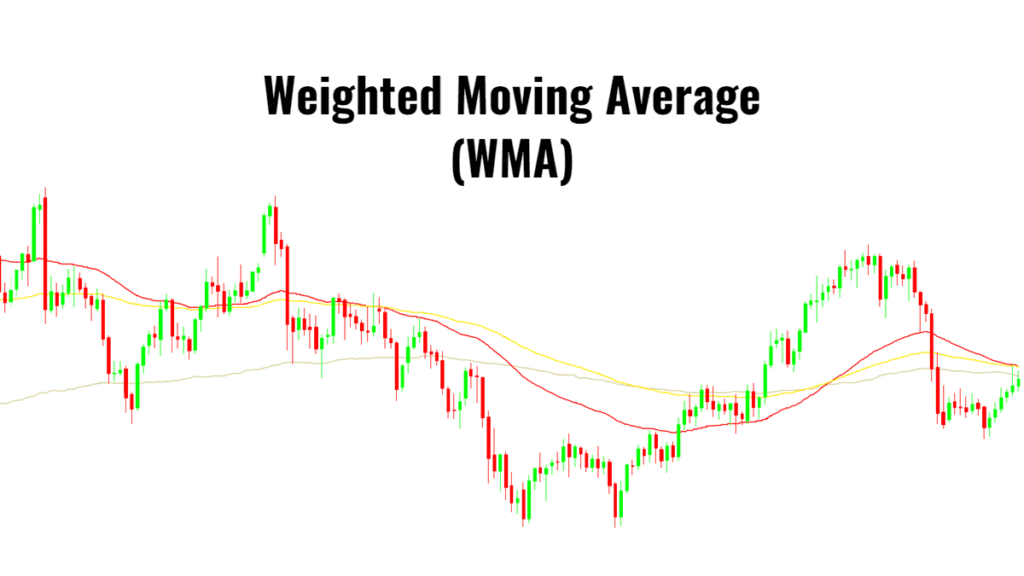

How to trade weighted moving average

Traders use WMA to identify potential buy and sell signals in the following ways:

- Crossovers: When the asset price crosses above the WMA, it signals a potential buy. A crossover below signals a potential sell.

- Divergence: When the price and WMA diverge, it indicates weakness or strength. Divergence between a rising price and falling WMA signals a potential reversal.

- Trend identification: A rising WMA indicates an uptrend and falling WMA signals a downtrend. Traders enter long when WMA turns up from down and short when it turns down from up.

- Support/Resistance: Previous highs or lows of the WMA act as dynamic support and resistance levels. Bounces off these levels can present low-risk entry opportunities.

- Filter short-term noise: By giving more weight to recent prices, WMA helps filter out minor fluctuations and focus on the underlying trend.

Pros and Cons

Some key advantages of using weighted moving average include:

- It assigns more importance to recent prices compared to older prices. This makes WMA more responsive to changes in the trend.

- By weighting prices exponentially, it provides a smoother average than simple moving average and filters out short-term volatility and noise better.

However, some drawbacks of WMA are:

- It is more complex to calculate than simple moving average as it involves weighting prices.

- As weights are assigned, older data is discarded. So not all the historical price data is utilized like in simple moving average.

- There are many possible weighting schemes. Choosing the right one requires some backtesting.

Weighted Moving Average vs Simple Moving Average

The main difference between simple and weighted moving average is that:

- Simple moving average gives equal importance to all data points in the period.

- Weighted moving average assigns higher weights to recent data points so they have a greater impact on the average.

As a result, WMA reacts faster to changes in trend but may also give more false signals in choppy markets. SMA lags trends but gives fewer false signals.

WMA provides a smoother average by exponentially decreasing weights. It helps filter out minor price fluctuations better than SMA. But SMA utilizes all historical data while WMA discards older data.

Conclusion

weighted moving average is a versatile technical indicator that assigns higher importance to recent price data. By smoothing short-term volatility, it helps traders identify trends and potential buy/sell opportunities.

While more complex than simple moving average, WMA reacts faster to changes in trends. It serves as a dynamic support/resistance level and also helps confirm trends or divergences with other indicators. Regular monitoring and backtesting different weighting periods is needed to use WMA effectively in trading.